SPONSORSHIP HAS NEVER BEEN A BETTER VEHICLE FOR THE AUTOMOTIVE INDUSTRY

By Tom Gladstone

There has never been a more opportune time for automotive brands to invest in sponsorship, given turbulence in the car industry, the loosening of brand loyalty in the sector, changing consumer priorities and the sustainability challenges being levelled at sports organisations. The category is ripe for disruption and an injection of distinctiveness – two qualities that car brands haven’t wholeheartedly embraced when it comes to marketing in general, let alone sponsorship. Let’s break down the various component parts, starting with the shift towards EVs.

The death of automotive brand loyalty

2022 saw the highest number of EV sales ever in the UK, making it the second largest fuel category after petrol. Reports suggest over half of drivers aged 16-49 will be switching to EVs in the next ten years. Rishi Sunak’s recent ‘screeching U-turn’ on climate policies, which included delaying the ban on new combustion engine vehicles until 2035, might slow the uptake, but it won’t change the direction of travel towards EVs. There’s a big question about how that shift will impact people’s inherent consideration sets. We might all have our go-to car brands at different levels of price and luxury when it comes to cars with a combustion engine, but will that translate to EV-expertise? Plenty of evidence suggests not, and many commentators believe the age of automotive brand loyalty is dead.

Source: GWI

That provides a great opportunity to make a play for ‘green’ (in both senses) consumer hearts and minds using the brand-building power of sponsorship. As always, there will be claims of green-washing to overcome, with climate activists recently calling for automotive brands to be banned from sponsoring major sports clubs, athletes, and competitions. But that simply makes it increasingly important for sport to wean itself off the traditional (internal combustion engine) automotive partnerships. The burning platform for car brands is clear, but there are also some burning issues for sports fans that pave the way for EVs to accelerate their involvement with sport.

The rise of the eco-conscious sports fan

First up, sports fans are increasingly eco-conscious. Environmental sustainability is the number one issue that UK sports fans think leagues and teams should be tackling. 38% of UK sports fans believe not enough is being done for sustainability by rightsholders. Our research into women’s sport fans suggests an even greater eco-consciousness among that ever-increasing fanbase. Sports fans are also 24% more likely to own an EV than the general public. Or looked at another way, EV owners watch (and play) sport significantly more regularly than non-EV owners.

The next generation of car-buyers are also particularly environmentally aware. Over two-thirds of sports fans aged 16 to 24 support environmental change and have higher expectations from brands, teams and athletes to support their values, according to new research from Global Web Index. When you think that more than half of people are 20 or younger when they get their first car, sport could provide a valuable priming opportunity to align with those younger consumer sensibilities.

Sports organisations need to get their ‘green house’ in order

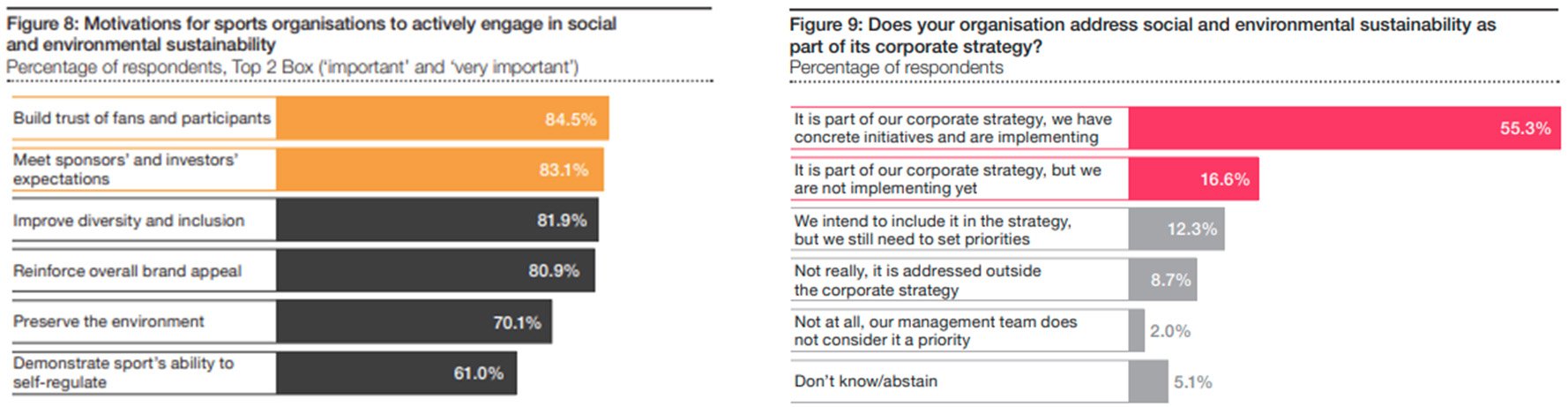

Added to the fan perspective, sponsors engaging the sports world will also find a sports community that has put sustainability at the top of the agenda. PWC’s 2021 Sports Survey found that 84.5% of sports organisations were motivated to engage in sustainability to build trust with fans, 83.1% wanted to meet sponsor and investor sustainability expectations and 55.3% said sustainability was part of their corporate strategy. It would be a real surprise if those numbers haven’t shifted upwards in the intervening years.

Source: 2021 PwC Sports Survey

And when it comes to rightsholders getting their own house in sustainable order, an automotive partner is low-hanging fruit. Most sports governing bodies have an inherent need for cars: supporting the elite performance team travel, enabling grassroots coaches up and down the country, supplying the general administrative workforce and delivering on event-based requirements – such as the Land Rover fleet currently employed by Rugby World Cup organisers. That is a lot of scope 1 emissions that can be reduced with a switch to EVs, and a handy VIK component of any car brand’s sponsorship investment.

Category disruption has left plentiful opportunities for driving brand fame

Over recent years the sponsorship landscape has seen a shift in the automotive category, from manufacturers to retailers. Cazoo and Cinch have been playing out their corporate battle on the sports field, hoovering up high visibility sponsorships across mainstream and niche sports. As with many emerging and challenger brand categories, sponsorship proved the brand-fame driving platform of choice, offering both reach and frequency to help create mental availability among as many category buyers as possible. Longer-standing retailers such as Peter Vardy and Arnold Clark have also got in on the action, forging high profile partnerships in Scottish Rugby and Women’s Football respectively. But challenges in the sector have seen a significant pull back from car retailer sponsorships, with Cazoo leading the exodus. Cinch may be following suit, if their early exit from the SPFL title sponsorship is anything to go by. This disruption has left rightsholders facing a gaping hole to fill in both their fleet provision and P&L.

Cazoo’s portfolio of sponsorships now with an automotive gap include World Snooker, the Professional Darts Corporation, The Hundred, The Derby, Aston Villa, and Everton. Indeed, across the Premier League only two out of twenty teams have an automotive manufacturer as a sponsor. Opportunities abound for EV brands looking to tap into sponsorship’s access to both audiences and cultural relevance at scale.

Automotive creativity in need of a recharge

So, rightsholders and fans – anti-greenwashing campaigners excluded – are primed for an influx of EV brands, but will they make the most of the opportunity? The automotive category recently has been creatively uninspired and can feel decidedly generic. While they may subscribe to the Byron Sharp theory of maximising mental availability, not many are capitalising on their distinctive brand assets – a key part of Sharp’s recommended approach. Brands default to an alignment with elite sport ‘performance’, often reinforced by messaging around shared focus on ‘reliability’ or ‘durability’ – hygiene factors in the category, not attributes that scream brand differentiation. ‘Innovation’ is another shared values ‘crutch’. But rarely is automotive technology and expertise surfaced to help sporting performance, despite the interchangeable claims cross the category to ‘drive success’, ‘power the team to glory’, or be the ‘driving force behind the sport’. The lack of differentiation and distinctiveness in positioning and messaging is stark.

But breaking category norms is possible. For inspiration from beyond the world of sponsorship, we’ve recently been gifted Fiat’s ‘Operation No Grey’ advert. Rightly lauded within the industry – scoring highly on both subjective creative and objective effectiveness measures – it even got Mark Ritson purring, and proffering a mantra that automotive brands in sponsorship would do well to adopt: ‘differentiation is not about finding unique aspects of your product or brand. It’s about relative differentiation. About having more of it than your competitors’.

Credit where it is due, there has been the odd notable exception of differentiated approach in sponsorship. Nissan’s integration of their Man City partnership and Guardiola ambassador deal – including the ‘Be More Pep’ campaign – repeatedly brings some creative flair (and not an insubstantial production spend) to the category. Another standout is Ford using their partnership with Ride London to champion not driving, showcasing their sustainability commitment. ‘Park the car’ is one of those beautifully counter-intuitive strategies and creative ideas, bringing to mind British Airway’s ‘Don’t Fly’ campaign during London 2012.

Differentiation is possible and needs to be turbo-charged by car brands in sponsorship, especially given that the EV sector will only become increasingly crowded. GlobalData estimates that the automotive industry currently spends $1.4 billion annually on sports sponsorships, from 657 deals. It’s about time they devoted a little more of that investment to creative differentiation.